Differences in the conditions borne by Black and white Americans can be measured by all kinds of metrics—life expectancy, infant mortality, rates of incarceration, and many more.

But according to Smart Money magazine, when it comes to quantifying the economic disparities between Black and white Americans, median net worth may be the most trenchant and clarifying measure of all. Says the magazine in blunt, yet utterly startling language,

White households in the United States had a median net worth of $118,300 in 2004, the most recent year for which Federal Reserve data is available—10 times the median net worth of the typical black household, which was just $11,800.

Why does this absolutely outrageous ratio exist?

According to the magazine, it’s

not merely the result of an income gap. It’s true that white households earn about twice as much as African-American households: an average of $76,960 a year versus $38,010, in 2004. That’s a big difference, but it’s not enough to explain the even larger chasms between the average equity in whites’ and blacks’ homes ($133,087 versus $39,294) or their investments ($119,513 versus just $8,817)—or their retirement accounts ($72,219 versus $18,187).

In fact, stresses Smart Money,

In fact, stresses Smart Money,

at comparable levels up and down the earnings ladder, white families have more savings and overall assets than black families. And after adjusting for age and education as well as income, white households are still better off. So it’s not just that whites make more money than nonwhites; even given equal amounts of money, whites build more wealth than nonwhites.

What is the explanation for this disparity, then? If, even adjusted for income, Black and white wealth click at such different rates, why does it happen?

The chief reason, says the magazine, is that “White Americans tend to put their disposable income into diverse financial instruments, which is the best recipe for accumulating lasting wealth.”

Blacks, by contrast, are less likely to enter the market and more likely to invest in items that lose value over time. Early research into racial differences in wealth, conducted in 1971, found that 90 percent of black Americans’ money was tied up in physical assets, such as cars. Things haven’t changed all that much, even as overall black wealth has increased. Among blacks now earning more than $50,000 a year, just 57 percent are invested in stocks and/or mutual funds, compared with 76 percent of whites, according to Ariel Investments and Charles Schwab. Meanwhile, compared with a white family of equal income, a black family will spend 29 percent more of its earnings on autos, clothes, jewelry and personal care, according to a 2007 study by Kerwin Kofi Charles and Erik Hurst of the University of Chicago and Nikolai Roussanov of the University of Pennsylvania.

Standard economic theory says that makes no sense: Put a white family and a black family in the same economic situation and they should make the same decisions about how to allocate their portfolios, based on rates of return, risks and other financial factors. They should be headed toward similar retirements.

However, by standard economic theory is not necessarily how the world works. As the mag notes, “People with similar cash flow don’t necessarily invest in similar ways, because human beings react to their own histories.” It then cites three critical realities that curtail Black wealth accumulation: 1) Financial traditions and legacies historically circumscribed by racism, 2) present-day racism, and 3) conspicuous consumption.

These causes have been summarized elsewhere, and more deeply, before. For example, in a February 2005 piece on the Black wealth gap, The Black Commentator cited Thomas M. Shapiro’s 2004 text, The Hidden Cost of Being African American: How Wealth Perpetuates Inequality, right. In it, the Commentator noted, Shapiro drew out the generational wealth transfer the has been far more lucrative for white people than for Black people.

These causes have been summarized elsewhere, and more deeply, before. For example, in a February 2005 piece on the Black wealth gap, The Black Commentator cited Thomas M. Shapiro’s 2004 text, The Hidden Cost of Being African American: How Wealth Perpetuates Inequality, right. In it, the Commentator noted, Shapiro drew out the generational wealth transfer the has been far more lucrative for white people than for Black people.

Whites are more likely to have parents who benefited from the land grants of the Homestead Act, who have Social Security or retirement benefits, or who own their own homes. With their far greater average assets, whites can transfer advantage from parents to children in the form of college tuition payments, down payments on homes, or simply self-sufficient parents who do not need their children to support them in old age. These are the invisible underpinnings of the black-white wealth gap: wealth legally but inhumanely created from the unpaid labor of blacks, the use of violence – often backed up by government power – to stop black wealth-creating activities, tax-funded asset building programs closed to blacks even as they, too, paid taxes. The playing field is not level today. For example, recent studies demonstrate that blatant race discrimination in hiring persists. But even if the playing field were level, the black/white wealth gap would still be with us.

What is the way to remedy this?

The Smart Money piece offers up “universal retirement accounts—giving assets or asset-building accounts to everybody, through the workplace or government” as the best solution, arguing that president-elect “Barack Obama has suggested a version of this, which would require employers who don’t have retirement plans to enroll their workers in direct-deposit IRA accounts (employees could opt out if they chose).”

The Smart Money piece offers up “universal retirement accounts—giving assets or asset-building accounts to everybody, through the workplace or government” as the best solution, arguing that president-elect “Barack Obama has suggested a version of this, which would require employers who don’t have retirement plans to enroll their workers in direct-deposit IRA accounts (employees could opt out if they chose).”

“The upside,” says the magazine, “is that it can work. When McDonald’s enrolled its managers in an automatic savings program, participation by African Americans increased from 50 percent to 95 percent in two and a half years.”

The downside, it says, though, is that taking over the process of saving for Black people is “paternalistic.”

There’s another downside that the piece doesn’t mention, though. It’s that this approach wouldn’t address the wealth gap. Any such program, equally and perfectly applied, without regard to race, would merely lift white and non-white participants equally. Black people would acquire more, but so would white people, leaving us, in a certain respect, where we started.

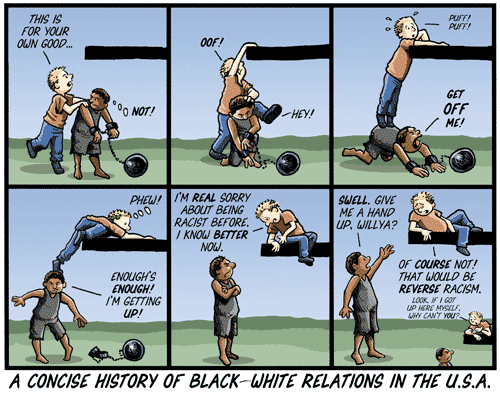

It is precisely this irony, as it turns out, that undergirds the logic, and proposed remediation, of the modern-day reparations movement. (This disparity is also encapsulated in the cartoon at the top of this post.)

That movement says the Black-white wealth gap was created immorally, over centuries, on purpose, with wide complicity of many entities, and its correction is must be fashioned in like manner, this merely in order for America to be just.

That movement says the Black-white wealth gap was created immorally, over centuries, on purpose, with wide complicity of many entities, and its correction is must be fashioned in like manner, this merely in order for America to be just.

It calls for a racial correction. It does this on the basis of a racial incorrection that took place when white people were, as the comic above says, “being racist before.”

Most white people, and many Black people, when surveyed, say they’re against reparations, although I strongly suspect it’s for different reasons. White people, I believe, mostly oppose it because they think they’ve given Black people way more than enough, which, from a Black perspective, is truly interesting.

Black people are against it because, a) they don’t want to appear needy, helpless, and on the dole, and, b) white people will never give in on this, they say, so why chase a pipe dream?

That last reason, b), interestingly enough, is also a major reason many Black people did not initially support Barack Obama…who, incidentally, is also against reparations, I’d argue, for the same reason many Black people were against him.

And around we go. Somehow, this has all got to come out in the wash, I guess.

Meanwhile, the gap persists. Hopefully, though, that won’t affect your last-minute Christmas shopping.

4 comments ↓

If the comic above is accurate, what do you call affirmative action programs?

You’ve missed the point on the opt-out asset program. It helps blacks more than whites because they need more help, eventually creating an equal playing field. White participation can’t go up 45% because most of them already have assets!

Not to mention that reparations wouldn’t fix the wealth gap, either, because of that conspicuous consumption problem. Legacy racism has nothing to do with spending 29% more on disposables.

Robyrt:

see/read Pierre Bourdieu and William Julius Wilson.

Wilson claims structure shapes culture. The structural limitations of “poverty” (or having less money than someone else) affect how one acts/spends/values etc.

Bourdieu claims culture is what reproduce inequality. Dominance are able to transform (/hide) economic assets in things that seem to be disinterested/unassociated with wealth and power. For example, high end educational degrees and appreciation for the arts etc.

Putting these two theoretical perspectives together might help you understand how ‘legacy racism’ has had an impact on the 29% more spending on disposable goods:

Its the culture, which is shaped by the structure. The structure is limited by the monetary inequality. The monetary inequality gap is reproduced uncontested by hiding wealth in “cultural capital”.

BTW- the comic might not be totally accurate for several reasons (first, the ball and chain have come off the black character… but believe me black people are still chained to a degree) but Affirmative Action does not help low-income blacks as much as we are all lead on to think it does.

Wilson criticizes the AA program because the primary beneficiaries tend to be middle and upper class blacks who, for all intents and purposes, don’t need the assistance. The blacks who DO need AA never make it high enough up to benefit from it… Wilson suggests doing away with Affirmative Action. Instead he suggests making large structural changes to society as a way of leveling out inequality. BTW- Wilson is black…not that it matters race is socially constructed anyway…

hotep friends.

i didn’t read the blog. But, the above cartoon needs to be mass distributed in India to explain a whoooole lotta things.

And the great unspoken point in all of this? Property Values.

There was an article in the New York Times magazine probably 15 years ago now about a white couple that moved into a black suburban neighborhood. There’s a quote from the article (that I, of course, can’t find) where the couple explains why they bought in that neighborhood. The asking price on a similar house in a white neighborhood was $800K. The house they bought? $400K.

Look at rates of housing appreciation in black neighborhoods. There’s your wealth gap right there.

Leave a Comment