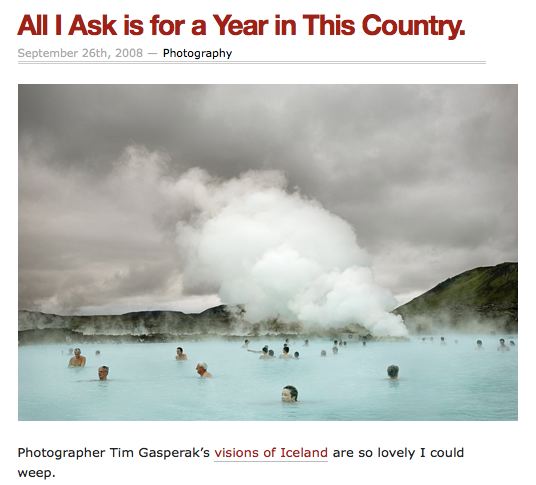

Did I speak too soon when, two weeks ago, I wistfully blogged that that I wanted to live a year in Iceland, below?

It sure appears so, with the announcement yesterday that—gulp—the whole country is on the verge of “wholesale economic collapse.”

Queues formed at petrol stations as Icelanders rushed to fill up before reported fuel shortages, while savers who tried to withdraw money from banks or sell bank shares on the internet found websites were not working. …

Sources said that Landsbanki and the country’s third-biggest bank, Glitner, will soon be fully nationalised, while Kaupthing had been forced to take state loans.

Can you imagine?

But the man I want to talk to this morning is James Surowiecki, from The New Yorker‘s financial page. In an April 21 piece—April! Six months ago!—he wrote these words:

By now, we’re all familiar with the major victims of the subprime meltdown: greedy mortgage brokers, overleveraged hedge funds, feckless banks and brokerages, incautious homeowners, and so on. But the crisis is also wreaking havoc in places that, on the surface, might seem to have nothing to do with the price of foreclosed homes in Miami. Places, that is, like Iceland.

… Many people suggest that it could become the “first national casualty” of the ongoing credit crunch. Until last year, Iceland’s economic track record in this decade had been phenomenal—its annual growth rate averaged close to four per cent over the past decade, and its per-capita gross national income is now higher than that of the U.S. This year, though, the country’s currency, the króna, has fallen twenty-two per cent against the euro; the economy has stagnated; and a global rating agency has put the nation’s three major banks on a credit watch. Now analysts are wondering whether the new Nordic Tiger will end up, instead, as “the Bear Stearns of the North Atlantic.”

He says “Bear Sterns” as opposed to “Lehman Brothers” because, remember: In April, LB still existed.

Definitely check out the piece. Not only does it describe the relevant geofinancial issues lucidly, but it reads like prophecy. The New Yorker needs to widely blast this and give Surowiecki a massive raise. And I need to call him, in the future, regarding my travel plans.

0 comments ↓

There are no comments yet...Kick things off by filling out the form below.

Leave a Comment